The 15-Second Trick For Stonewell Bookkeeping

Not known Details About Stonewell Bookkeeping

Table of ContentsNot known Factual Statements About Stonewell Bookkeeping The smart Trick of Stonewell Bookkeeping That Nobody is Talking AboutThe Single Strategy To Use For Stonewell BookkeepingStonewell Bookkeeping - The FactsStonewell Bookkeeping for Dummies

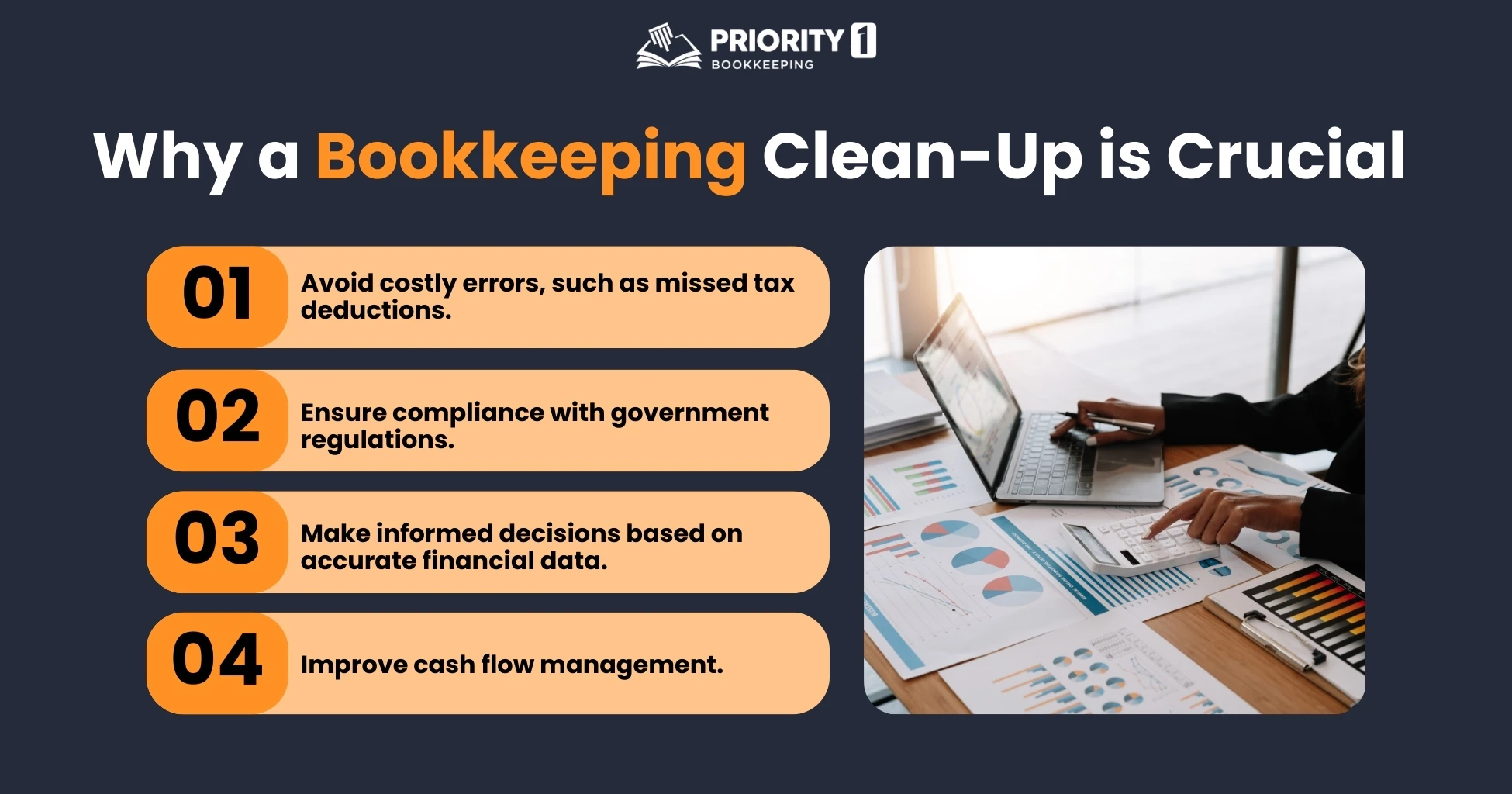

Here, we answer the inquiry, how does bookkeeping help a service? The true state of a company's financial resources and money circulation is always in flux. In a feeling, accountancy books stand for a photo in time, but only if they are upgraded typically. If a firm is taking in bit, a proprietor has to take activity to boost revenue.

It can additionally solve whether to increase its very own payment from customers or clients. However, none of these verdicts are made in a vacuum cleaner as accurate numeric info have to copyright the financial choices of every small company. Such data is put together via bookkeeping. Without an intimate expertise of the characteristics of your capital, every slow-paying customer, and quick-invoicing creditor, becomes an event for anxiousness, and it can be a tedious and dull job.

Still, with proper capital management, when your publications and journals depend on day and systematized, there are much fewer question marks over which to worry. You understand the funds that are available and where they drop short. The news is not always excellent, but at the very least you understand it.

The Definitive Guide to Stonewell Bookkeeping

The puzzle of deductions, credits, exemptions, timetables, and, certainly, charges, is adequate to simply give up to the internal revenue service, without a body of well-organized paperwork to sustain your insurance claims. This is why a devoted bookkeeper is vital to a small organization and deserves his or her weight in gold.

Having this details in order and close at hand lets you submit your tax obligation return with convenience. To be sure, a company can do every little thing right and still be subject to an Internal revenue service audit, as several currently recognize.

Your business return makes claims and depictions and the audit targets at validating them (https://hirestonewell.carrd.co/). Excellent bookkeeping is all regarding linking the dots between those representations and truth (small business bookkeeping services). When auditors can adhere to the information on a ledger to invoices, bank declarations, and pay stubs, to name a couple of files, they promptly find out of the expertise and honesty of business organization

Not known Facts About Stonewell Bookkeeping

In the same way, haphazard bookkeeping contributes to tension and stress and anxiety, it likewise blinds organization proprietor's to the possible they can recognize in the future. Without the info to see where you are, you are hard-pressed to set a location. Just with understandable, thorough, and valid information can a company owner or administration group plot a training course for future success.

Entrepreneur understand best whether a bookkeeper, accounting professional, or both, is the best solution. Both make crucial payments to an organization, though they are not the exact same career. Whereas a bookkeeper can collect and arrange the info required to support tax obligation prep work, an accountant is much better matched to prepare the return itself and actually evaluate the income declaration.

This post will dive into the, including the click here for info and exactly how it can benefit your service. Accounting involves recording and arranging economic deals, consisting of sales, acquisitions, repayments, and invoices.

By routinely upgrading financial records, accounting helps services. This helps in quickly r and saves companies from the tension of browsing for files during deadlines.

9 Simple Techniques For Stonewell Bookkeeping

They are primarily concerned about whether their money has actually been used appropriately or not. They definitely desire to recognize if the business is earning money or otherwise. They also desire to understand what potential business has. These facets can be conveniently managed with accounting. The revenue and loss declaration, which is ready regularly, shows the earnings and additionally figures out the potential based on the revenue.

By keeping a close eye on monetary documents, organizations can set practical goals and track their progress. Routine bookkeeping ensures that businesses remain certified and avoid any kind of fines or lawful concerns.

Single-entry bookkeeping is basic and works ideal for little companies with couple of deals. It does not track assets and liabilities, making it much less thorough contrasted to double-entry accounting.

Facts About Stonewell Bookkeeping Revealed

This might be daily, weekly, or monthly, depending on your company's dimension and the quantity of purchases. Don't wait to look for assistance from an accounting professional or accountant if you find handling your financial documents testing. If you are seeking a complimentary walkthrough with the Audit Remedy by KPI, call us today.